South Korea visa is slowly gaining popularity as a strong visa. South Korean visa offers VISA-FREE access to only a handful of countries as of now, but it’s only a matter of time. As of 2024, there are 8 VISA-FREE countries for South Korea visa or residence card. In this article, I will walk you through these countries, eligible nationalities, permitted South Korean visas and stay duration.

Visa Traveler

Exploring the world one country at a time

Global Visa Requirements for Travelers and Visitors

Step-by-Step Guidance on Worldwide Visas. Insights and Expertize from Visa Experts. Signup and get our FREE eBook - The Secret to VISA-FREE Travel.

SUCCESS!

Check your email inbox for more details!

THIRUMAL’S ADVICE WAS FEATURED ON

Featured Posts

38 countries you can travel VISA-FREE with Canada visa [2024 Edition]

18 VISA-FREE Countries You Can Visit with Australian Visa or PR [2024 Edition]

43 countries you can travel VISA-FREE with UK visa [2024 edition]

35 VISA-FREE Countries for Canadian PR Holders [2024 Edition]

53 countries you can travel VISA-FREE with US visa [2024 edition]

48 VISA-FREE Countries for US Green Card Holders [2024 Edition]

How to Fill DS-160 Form for US Visa: A Step-by-Step Guide (with screenshots)

How to schedule US visa appointment: A step-by-step guide

Latest Posts

8 VISA-FREE Countries for South Korea Visa or PR [2024 Edition]

14 VISA-FREE Countries You Can Visit With Japan Visa or PR [2024 Edition]

Japan visa is growing in popularity, partly due to the Japanese passport. Because the Japanese passport has become such a strong passport in recent years, Japan’s visa is gaining trust as a strong visa. Japan visa may not be as strong as a US or Canada visa, but it’s still powerful enough to get you access to 14 countries in 2024. In this article, you will learn about these 14 countries, who can enter these countries and what visas are permitted.

13 VISA-FREE Countries You Can Visit with New Zealand Visa or PR [2024 Edition]

New Zealand visa may not be as powerful as other visas, but it can still get you VISA-FREE entry to a few countries. As of 2024, there are 13 VISA-FREE countries you can visit with New Zealand visa or residence permit. In this guide, you will learn about these 12 countries, whether or not they accept e-Visas, eligible nationalities and the entry rules to keep in mind.

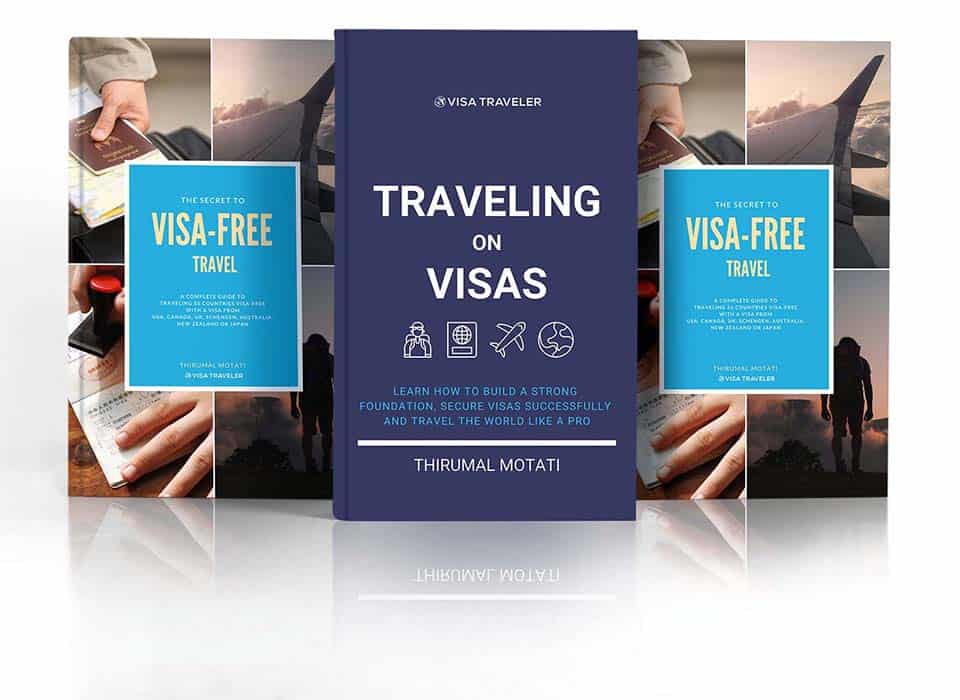

Books

If you have a “weak” passport, you already know how difficult it is to travel the world. You need visas to pretty much every country in the world. My books will teach you how to secure visas successfully and how to grow your VISA-FREE countries list. TRAVELING ON … Learn More About Our Books

My Story

Hello travelers! I'm Thirumal Motati. I'm a full-time world traveler and digital nomad. I have been exploring the world on my "weak" passport. I have spent a ton of time researching, planning and applying for visas. I started this website to help travelers that rely on visas. … Learn More About Us

What readers are saying

“I don’t know how to thank you. Watching cricket in UK has always been my childhood dream. I was so dejected when I saw my visa got rejected. You were the only person who gave me advice without looking for any remuneration. I was able to sleep for the past 1 month only because of your 3 words “You’ll be fine”. Hope to see you one day in my life. You are a great man.

– Ananlan K, Singapore

“I have no words to explain you how grateful I am for your prompt response and information provided. I went through few more blogs of your's and I am fond of it. People like you are a gem. I wish our paths cross each other anytime soon. Lots of thanks and wishes for your future prospects! Keep blogging.

– Alok S, India

“I was going through your travel blog which I love and wanted to thank you for mentioning about documenting large deposits and ensuring expenditure is not more than half of savings or more than twice the income. The article on how to avoid UK visit visa refusals is invaluable. Many thanks again for all your help and incredibly valuable advice.

– Harini H, Sri Lanka